Recent Changes in GST based on 47th GST Council Meeting – GST Rates

All the changes are effective from July 18, 2022. The transition period needs where invoice raised before the change in rate of tax but payment made after change in rate of tax and such other similar situations need to be handled carefully.

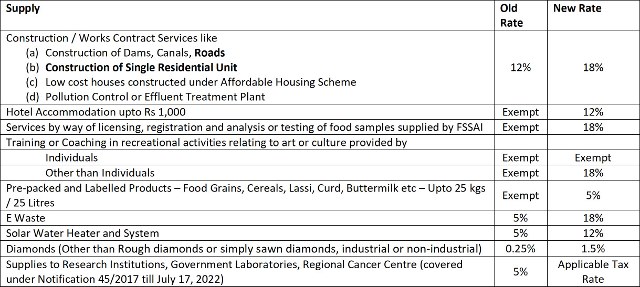

1. Summary of Major Change in Tax Rates in case of Goods and Services

2. Changes in case of Accommodation Services

- Hotel Accommodation upto Rs 1,000 per day was exempt from GST. This service will be liable to tax at the rate of 12%. Accordingly, Hotel Rooms will be subject to following taxes

- Hospitals providing accommodation services which forms part of the Health Care Services, would be required to charge GST at the rate of 5% on any rooms which are rented out at more than Rs 5,000 per day. GST will not be applicable in case of rooms provided in ICU, CCU, ICCU or NICU

- Renting of Residential Dwelling for use as residence to a registered person will be liable to tax from July 18, 2022 and the registered person would be required to discharge the GST on the same under RCM.

3. Changes in case of Tour Operator Services

- Tour Operator Services to foreign tourist to the extent the tour is conducted partly in India and partly outside India – To the extent conducted outside India will continue to be exempt from GST. However, the tour to the extent conducted in India will be liable to GST at the rate of 5%

- Since a consolidated consideration is charged for the entire tour, mechanism to compute the value of supply to the extent of tour conducted in India has been prescribed

4. Changes in case of Goods Transport Agency

- GTA has been given an option to either opt to pay taxes under forward charge or shift the tax liability to the service recipient where the recipient is a specified person. Effective July 18, 2022, the taxation on GTA would be as follows

- Renting of Goods Carriage where the fuel price is included in the consideration – Rate of tax has been reduced to 12%. However, vehicle given on hire to Goods Transport Agency (whether opting to pay taxes under Forward Charge or Reverse Charge) will continue to be exempt under Sl No.22(b) of Notification 12/2017

- Additionally, exemption from GST on consignment transport not exceeding Rs 1,500 and single consignment not exceeding Rs 750 has been withdrawn

We request you to peruse through the same and we would be glad to discuss the same with you at any time of your convenience. Additionally, request you to note that we plan to conduct a webinar on July 22, 2022 between 5pm and 7pm to discuss all the changes in detail and will share the details of the same with you shortly.

Regards,

Team HSKA