Recent Changes in GST based on 47th GST Council Meeting – GST Rules

All the changes are effective from July 5, 2022 itself except Para 5 relating to computation of interest which has been introduced retrospectively from July 1, 2017

1. Changes in Form GSTR 3B

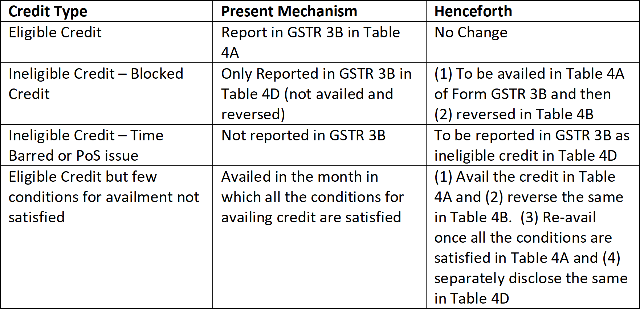

- Major Changes have been announced in the Form GSTR 3B. These changes will impact the manner in which the ITC is being reported in the monthly returns

- The objective of these changes is to ensure that taxpayer should report the credit in the monthly returns based on the entries appearing in Form GSTR 2B and not based on the balance in their ITC register. A detailed Circular to explain the new credit disclosure mechanism has been issued [Circular No. 170/02/2022-GST]

- The manner of availing the credit in Form GSTR 3B once the revised tables are updated on the GST Portal are as follows

- Tracking of these credits and reconciliation of the same with the books could be a tedious task. Especially in case of blocked credits, the entries would appear in Form GSTR 2B whereas in the books the same would have been expensed off at the time of accounting itself. The entire process of recording the credits in the books and availment of the same in the returns will undergo a massive change

- Mandatory reporting of interstate supplies made to unregistered persons, composition taxable persons and UIN holders is required to be made at place of supply wise

- Apart from the above, separate tables are being provided to enable the restaurant owners to declare their turnover on which e-commerce operators are required to discharge GST and vice versa

2. Changes related to GST Returns

- Excess balance in Electronic Cash Ledger can now be transferred to another GSTIN of the same taxable person situated either within the same state or outside the state

- Due Date for filing CMP 08 by Composition Dealers for Q1 of FY 2022-23 extended to July 31, 2022

- Late fee for delay in filing Form GSTR 4 by Composition Dealers for FY 2021-22 has been waived for the period May 1, 2022 to July 28, 2022. Additionally, a GSTN advisory has been issued to clarify that the issue of negative liability appearing in the annual return has also been rectified

- Annual Returns in Form GSTR 9 for FY 2021-22 is not required to be filed by taxpayers having turnover less than Rs 2 Crores

- In case the registration of a taxpayer is suspended, pending cancellation, for non-filing of returns and the taxpayer files the returns, the suspension of registration will be automatically revoked

- UPI and IMPS can now be used for making GST payments

- Relaxations in disclosures in Form GSTR 9 and 9C will continue for FY 2021-22 as well thereby allowing the taxpayer to report the transactions on consolidated basis in various tables. However, 6 Digit HSN wise outward supplies will have to be reported

3. Changes related to Refunds

- In case a taxpayer encashes his input tax credit accumulated on account of inverted duty structure or IGST paid on export of goods and repays the erroneous refund sanctioned to him by cash, the ITC to the extent re-paid by cash will be re-credited to his electronic credit ledger

- For the purpose of computation of refund on accumulated ITC, value of Export of Goods would be FOB Value of Goods declared on the Shipping Bill or Value declared in the tax invoice, whichever is less. Statement for filing refund also amended to add additional table to furnish invoice level FOB value – This amendment effectively leads to reduction in export value of goods to the extent of freight and insurance and could lead to reduction in refund amount

- Formula for inverted duty structure refund has been altered to provide that only such portion of the ITC related to INPUTS which has been used for discharging the liability related to inverted duty structure turnover will be reduced from the NET ITC – Presently, the ITC related to both INPUTS and INPUT SERVICES used for discharging the liability related to inverted duty structure was being reduced from the NET ITC. This amendment will lead to increase in refund

4. Extension of Time Lines

- Due date for passing order under Section 73 extended from November 4, 2022 to September 30, 2023 in cases involving short payment of tax / non-payment of tax / incorrect availment of Input Tax credit. With this amendment, the revenue authorities will now be able to issue SCN relating to FY 2017-18 till June 30, 2023 in cases where no allegations of fraud / suppression are made

- The period from March 1, 2020 to February 28, 2022 has been excluded for the purpose of computation of time limit for issuance of order relating to recovery of erroneous refunds. The revenue authorities get more time to review the refund orders

- The period from March 1, 2020 to February 28, 2022 has been excluded for the purpose of computation of time limit for filing of refund application. The refunds filed during the said period and rejected as time barred, will now be considered as filed within the due date and hence eligible for refund